In today’s fast-paced startup ecosystem, the rules of success are changing faster than ever. The era of horizontal software, with tools designed to serve every industry, still grabs headlines, but a more strategic revolution is quietly reshaping the market. Vertical SaaS has stepped into the spotlight, capturing the attention of venture capitalists and redefining what it means to build a winning software business.

Rather than trying to be everything to everyone, these startups focus on doing one thing exceptionally well for a specific industry. From landscapers and auto repair shops to physical therapists and cannabis dispensaries, niche-focused solutions are proving that deep industry knowledge, superior product value, and strong business fundamentals lead to rapid growth, high retention, and profitability.

In this blog, you will explore why Vertical SaaS is dominating, see the factors driving investor interest, and understand how this shift is reshaping the future of software.

Understanding the Vertical vs. Horizontal Divide

- In this part, you learn what Vertical and Horizontal markets actually mean. A Vertical market focuses on a specific industry, such as healthcare or education, offering solutions tailored to that field. A Horizontal market, on the other hand, provides products or services that can be used across multiple industries, such as email or accounting software. Understanding this divide helps you see how businesses target their audiences differently and design strategies based on their market focus. Now, let’s take a brief look at Vertical and Horizontal SaaS.

a. Horizontal SaaS

- When you use Horizontal SaaS, you’re using software that works for many types of businesses, no matter the industry. For example, think about Slack, a communication tool used by schools, tech companies, and restaurants alike. You can chat with your team, share files, and organize projects all in one place. Another example is Salesforce, which helps different companies manage their customers and sales. These tools solve common business problems, like communication or customer tracking, making them useful everywhere. However, since they target such a wide audience, they also face high competition in the market.

b. Vertical SaaS

- Vertical SaaS is software created to meet the specific needs of a single industry. It includes the industry’s workflows, rules, and terminology, making it perfectly suited for that field. Unlike general tools, it solves specialized problems that only certain industries face.

- For example, Toast is made for restaurants — it manages orders, menus, staff schedules, and payments, all customized for restaurant operations. Another example is Procore, which helps construction companies handle project tracking, budgeting, and safety compliance. These tools go beyond basic functions; they fit your industry’s exact requirements, giving you a competitive advantage and improving efficiency within your specific field.

The Core Reasons Investors Are Betting Big on Vertical SaaS

- In this part, you’ll learn why investors are so excited about Vertical SaaS. These companies focus on specific industries, which means less competition, higher customer loyalty, and easier growth. When you build software that fits an industry’s unique workflows and rules, businesses are willing to pay more and stick around longer. Investors love this because it creates predictable revenue, faster market dominance, and a clear path to success, making Vertical SaaS a very attractive area to put their money and trust.

2.1 Escape from the Red Ocean of Competition

- The Horizontal SaaS market can feel like a red ocean, full of intense competition. Imagine you’re launching a new CRM tool. You’re not just competing with other startups — you’re going up against giants like Salesforce and Microsoft Dynamics, who have huge budgets, strong brands, and millions of users. You’ll need to spend a lot on marketing and sales to get customers, and it’s hard to show why your tool is better than the many similar options. The competition is fierce, making differentiation difficult and customer acquisition costs (CAC) very high, which can be risky for a small company trying to survive.

- Whereas Vertical SaaS follows a blue ocean strategy, meaning it targets an underserved industry with little direct competition. For example, think about Denticon, a software made just for dental clinics. Unlike general tools like Salesforce, it handles appointments, patient records, billing, and insurance specifically for dentists. Because it focuses only on this niche, you don’t compete with massive horizontal SaaS giants, and your startup can quickly become the go-to solution in the dental industry. This focused approach lets you capture the market faster, build strong customer loyalty, and establish a dominant position without getting lost in a crowded horizontal market.

2.2 Deeper Product Embedding and “Stickiness”

- Horizontal SaaS often lacks deep embedding in a company’s workflow, which makes it easy to switch. For example, your company might use Salesforce for CRM, but if HubSpot offers a better price or features, you can easily change. The switching cost is low because these tools are just one part of a bigger tech stack. This means customers aren’t very loyal, and the software doesn’t become “sticky,” unlike Vertical SaaS, which integrates deeply into an industry’s daily operations.

- When a Vertical SaaS platform is deeply embedded in your business, it becomes extremely sticky. For instance, a fitness studio using Mindbody doesn’t just schedule classes — it handles membership management, class bookings, payments, staff schedules, and marketing. Switching to another platform would be difficult and risky because all daily operations rely on it. Similarly, a life sciences company using Veeva Systems depends on it for regulatory compliance, clinical trials, and customer management, making migration a huge challenge. This deep integration keeps customers loyal, lowers churn, and provides investors with steady recurring revenue and a profitable, predictable business.

- Migrating away isn’t just swapping tools; it’s a complex, risky, and disruptive process that can affect your entire operations. This high switching cost reduces churn, a key metric investors value. A sticky customer ensures steady recurring revenue, making the business more profitable and predictable over time.

2.3 Superior Unit Economics and Efficient Customer Acquisition

- Vertical SaaS companies have better unit economics because their marketing and sales are highly efficient. When you target a specific industry, your message reaches the right audience, reducing customer acquisition costs (CAC) [the amount of money a company spends to get a new customer]. This makes it cheaper and faster to gain loyal customers, improving profitability and growth potential.

a. Targeted Marketing:

- With Vertical SaaS, you know exactly who your customer is and where to reach them. Instead of spending huge amounts on broad ads like Google AdWords for general terms, you can focus on trade publications, industry conferences, and partnerships with associations. Your marketing message directly addresses the audience’s daily challenges and specific needs, making it much more effective. This targeted marketing saves money, attracts the right customers faster, and builds stronger trust and loyalty in your chosen industry.

b. Higher Conversion & Lower CAC:

- With this, your targeted approach results in higher conversion rates and a significantly lower Customer Acquisition Cost (CAC). For example, a landscaping company using software designed specifically for them benefits from features like job costing, chemical application tracking, and client property maps. The value is immediate and clear because the software addresses their specific problems. This makes it easier for you to convert customers, reduce marketing expenses, and quickly build a base of loyal users who remain committed to your industry-focused solution.

c. Higher Lifetime Value (LTV):

- With Vertical SaaS, your customers stay loyal because the software is essential for their daily work. For example, a construction company using Procore might begin with project management and later add budget tracking, safety compliance, and resource scheduling. This gradually increases the Lifetime Value (LTV) [the total revenue a customer is expected to generate for your business over the entire time they stay with you] of each customer. When combined with a low Customer Acquisition Cost (CAC), it creates an excellent LTV/CAC ratio, making the business very attractive to SaaS investors looking for steady, profitable, and scalable growth.

2.4 The Power of the Niche Network Effect

- The niche network effect happens when a Vertical SaaS platform becomes more useful as more people from the same industry start using it. Its value isn’t just the software itself—it’s also the connections, collaboration, and shared resources it enables. The more businesses join, the stronger the network gets, making it tough for competitors to catch up. A new platform would have to recreate not just the software but the whole industry ecosystem to compete successfully.

- For example, a Vertical SaaS platform for the legal industry grows stronger as more law firms join. When you use it, you can securely share documents, connect with other firms, and collaborate on cases. Similarly, a platform for builders, architects, and subcontractors lets teams communicate and coordinate seamlessly. The more participants join, the more valuable and efficient the network becomes, making it extremely hard for a new platform to replicate this industry-specific ecosystem.

2.5 Defensibility and Sustainable Moat Building

- Defensibility and a sustainable moat mean that a business is hard for competitors to copy. Vertical SaaS companies create this by combining domain expertise, brand reputation, and valuable data. The defensibility isn’t just in the software code; it’s in the deep understanding of an industry’s workflows, compliance rules, and relationships, which takes years to build. A strong brand can become synonymous with the niche, making your company the first choice. Additionally, collecting and analyzing industry-specific data gives you insights that others can’t easily replicate. Together, these factors make your business highly resilient and competitive.

- For example, ServiceTitan in the home services industry has built a strong moat. Its software isn’t just tools for scheduling or invoicing; it includes deep knowledge of plumbing, HVAC, and electrical workflows, licensing requirements, and supplier networks. ServiceTitan’s brand is so well-known that many home service businesses automatically think of it first. On top of that, by serving hundreds of companies, it gathers data on job times, pricing, and customer preferences, which can be analyzed and used for benchmarks and insights. This combination of expertise, brand recognition, and data makes it extremely difficult for a competitor to replicate.

2.6 Clear Paths to Expansion and Adjacency

- Clear paths to expansion and adjacency mean that a Vertical SaaS company isn’t limited by its initial niche. You can grow by upselling additional modules, expanding to adjacent industries, or offering financial services. Starting with a core product, you can add extra features that solve more of your customers’ problems, increasing revenue. You can also move into similar niches where your expertise and software can be applied. Finally, by becoming the central system for a business, you gain insight into operations and finances, enabling embedded financial services, which can become a major new revenue stream beyond the software itself.

- For example, Mindbody started by helping fitness studios manage class schedules and bookings. Over time, it added modules for payments, memberships, marketing, and retail sales, giving studios more tools in one platform. Then it expanded to related niches like yoga, wellness centers, and salons, using its expertise in health and wellness businesses. Later, it offered financial services like payroll and payment processing, because it understood each studio’s revenue and operations. This mix of upselling, vertical expansion, and financial services created multiple growth paths, helping Mindbody grow faster and attract investors.

Case Studies in Vertical SaaS Dominance

- Vertical SaaS success isn’t a coincidence; it follows a repeatable pattern across different industries. When you study these organizations, you see common traits: deep domain expertise, growth driven by a product that fits perfectly within a niche, and smart expansion strategies. These industries become the essential operating system for their target market, making businesses rely on them daily and creating strong customer loyalty that competitors find hard to challenge.

3.1 ServiceTitan: The Titan of Home Services

a. The Vertical:

- ServiceTitan serves the home services industry, including plumbing, HVAC, electrical, and other trades. It is a Vertical SaaS because it focuses on the specific workflows, compliance rules, and needs of these businesses. Unlike generic software, it provides tools that fit the daily operations of home service companies perfectly, making it highly specialized and efficient for the niche it targets.

b. The Problem:

- Before ServiceTitan, home service businesses used clunky software or pen and paper for dispatching, invoicing, and inventory. This caused mistakes, delays, missed revenue, and unhappy customers. Business owners struggled to track performance and efficiency, and there was no central system to manage operations. These inefficiencies limited growth and made running a smooth, profitable business very challenging.

c. The Vertical SaaS Solution:

- ServiceTitan offers an all-in-one platform that manages an entire home service business. It includes smart dispatching, invoicing with photos, inventory tracking, customer communication, and marketing ROI tools. Each feature is customized for home services, solving problems that generic software cannot. It helps you save time and money, improves customer experience, and provides a central hub for running operations efficiently.

d. Why It’s Dominant:

- ServiceTitan is dominant because the founders understand the industry deeply from personal experience. The platform becomes the central hub for all operations, making it very sticky. Businesses rely on it for scheduling, billing, inventory, and marketing, so switching is hard. Expanding into adjacent trades like HVAC and electrical helped capture a large, fragmented market, giving ServiceTitan strong market dominance.

e. The Investor Appeal:

- Investors love ServiceTitan because it has digitized a massive offline industry, creating huge growth potential. Being the central system allows for embedded financial services like payroll, payments, and lending, creating extra revenue streams. Its strong market position, loyal customers, and scalable model make it highly attractive. Investors see predictable profits, long-term growth, and a valuation exceeding $9.5 billion, demonstrating the power of Vertical SaaS.

3.2 Veeva Systems: The Blueprint for Regulated Industries

a. The Vertical:

- Veeva Systems serves the life sciences industry, including pharmaceuticals and biotech companies. It is a Vertical SaaS because it focuses on the specific regulatory requirements, workflows, and compliance needs of this highly regulated sector. Unlike general software, Veeva provides tools built for clinical trials, drug applications, and regulated sales processes, making it essential and highly specialized for life sciences companies.

b. The Problem:

- Life sciences companies face strict regulations from bodies like the FDA. Using horizontal software like Salesforce was risky because it couldn’t handle compliance, audit trails, or clinical trial management. Companies struggled to manage critical processes safely, risking fines, delays, or failed approvals. Running operations without industry-specific software made compliance complicated and increased business risk significantly.

c. The Vertical SaaS Solution:

- Veeva created a cloud-based suite built exclusively for life sciences. Its tools, like Veeva CRM and Veeva Vault, manage sales, marketing, clinical data, and regulatory submissions, all pre-validated for compliance. By providing software that matches the industry’s unique workflows and strict rules, Veeva allows you to operate safely and efficiently, eliminating risks and streamlining all regulated business processes in one central platform.

d. Why It’s Dominant:

- Veeva dominates because it has made regulatory compliance its core strength. The platform understands the language, workflows, and challenges of life sciences, letting it outperform general software like Salesforce. Its deep industry focus creates a strong moat, making it very hard for competitors to copy. As a public company, Veeva shows that Vertical SaaS can become essential and highly respected in a niche market.

e. The Investor Appeal:

- Investors value Veeva because it proved a Vertical SaaS company can dominate even against tech giants. Its software is mission-critical, ensuring companies cannot easily switch. Predictable revenue, high profit margins, and scalability make it very attractive. Investors see a business with strong growth potential, defensibility, and essential industry value, making it a highly profitable and stable investment in a complex, high-value market.

3.3 Toast: Serving the Restaurant Industry

a. The Vertical:

- Toast serves the restaurant industry, including food trucks, small cafes, and large chains. It is a Vertical SaaS because it focuses on the specific needs of restaurants, such as order management, inventory tracking, and customer engagement. Unlike generic software, Toast is built to handle all aspects of a restaurant’s operations, making it highly specialized and essential for businesses in this niche market.

b. The Problem:

- Before Toast, restaurants relied on traditional POS systems that were expensive, rigid, and hard to integrate. They struggled with online ordering, delivery management, and detailed inventory tracking. This caused inefficiencies, slowed service, and limited growth. Restaurants needed a central platform that could manage both front-of-house and back-of-house operations efficiently, while improving customer experience and reducing operational headaches.

c. The Vertical SaaS Solution:

- Toast offers an all-in-one platform for restaurants. It integrates front-of-house operations like POS and tableside ordering, back-of-house functions like kitchen display and inventory management, and customer engagement tools like online ordering and loyalty programs. By providing all these features in one platform, Toast helps you run your restaurant smoothly and efficiently, eliminating data silos and streamlining daily operations.

d. Why It’s Dominant:

- Toast is dominant because it understands that restaurants have holistic needs. Its platform eliminates integration headaches by connecting all operations in one system. Expanding into payment processing, payroll, and lending through Toast Capital made it even more essential. This deep integration and focus on the restaurant’s entire workflow created strong customer loyalty and a leading position in the market.

e. The Investor Appeal:

- Investors are attracted to Toast because it serves the large food service industry and offers a clear growth path. Its software and hardware sales are complemented by recurring revenue from payments, payroll, and financial services. This combination makes the business highly profitable and scalable, and its market dominance and high-margin services make it an attractive investment opportunity, eventually leading to a successful IPO.

3.4 Procore: Rebuilding Construction Management

a. The Vertical:

- Procore serves the construction industry, focusing on general contractors, subcontractors, and project owners. It is a Vertical SaaS platform designed specifically for managing construction projects from start to finish. By addressing the unique challenges and workflows of this industry, it provides tools that improve coordination, reduce delays, and make large construction projects easier to manage effectively.

b. The Problem:

- Before Procore, the construction industry suffered from poor communication and inefficiency. Teams used emails, paper plans, and spreadsheets, which caused delays, cost overruns, and confusion. Different groups worked in silos, and important updates were often missed. This lack of a centralized system made it hard to track project progress and keep everyone on the same page.

c. The Vertical SaaS Solution:

- Procore created a unified cloud-based platform where everyone involved in a project can collaborate in one place. It includes tools for project management, budgeting, safety, and field productivity. You can access it from any device, making it easy for managers and workers to stay connected and informed, whether they are in the office or on the job site.

d. Why It’s Dominant:

- This SaaS platform became dominant because it focused on simplicity and mobility. Its easy-to-use design allowed even field workers to adopt it quickly. As more contractors, architects, and owners used it, the network effect made the platform more valuable for everyone. It became the central hub for construction projects, ensuring better communication and fewer mistakes.

e. The Investor Appeal:

- Investors are drawn to Procore because it serves a trillion-dollar construction industry ready for digital transformation. Its model allows it to expand within large firms, increasing usage over time. High customer retention and steady recurring revenue make it a reliable, long-term investment, and its successful IPO proved the strength of its market position and growth potential.

3.5 Mindbody: The Operating System for Wellness

a. The Vertical:

- Mindbody serves the wellness industry, including gyms, salons, yoga studios, and spas. It is a Vertical SaaS because it is built specifically for appointment-based wellness businesses. By focusing on this niche, you get software that manages schedules, client management, and payments efficiently. Its design fits perfectly with the daily operations of wellness businesses, making it highly specialized.

b. The Problem:

- Before Mindbody, wellness businesses struggled to manage appointments, client records, and payments efficiently. Many used manual systems or separate tools that didn’t work together. This caused confusion, wasted time, and took attention away from providing services. You see that small businesses needed a central platform to simplify operations and improve customer experience while saving time.

c. The Vertical SaaS Solution:

- It offers an all-in-one platform for wellness businesses. It handles scheduling, payments, marketing, and customer management in one place. The Mindbody App also connects new customers to your services. By providing a complete system, you can run your business efficiently, reduce mistakes, attract more clients, and manage operations without juggling multiple software tools.

d. Why It’s Dominant:

- Mindbody is dominant because it created a two-sided marketplace that benefits both businesses and consumers. For wellness owners, it is an essential tool for operations. For consumers, it is the go-to app to discover and book classes or appointments. This creates a strong network effect, increasing customer loyalty and making it difficult for businesses to switch platforms.

e. The Investor Appeal:

- Investors are attracted to Mindbody because it serves a fast-growing wellness industry. Its scalable marketplace model allows expansion as more businesses and consumers join the platform. Mindbody provides recurring revenue and a strong growth story. Its $1.9 billion acquisition by Vista Equity Partners demonstrates its market value, long-term potential, and attractiveness as a profitable, high-growth investment.

3.6 Guidewire: Insuring the Insurance Industry

a. The Vertical:

- You see that Guidewire serves the insurance industry, especially Property and Casualty (P&C) insurers. It is a Vertical SaaS company because it builds software specifically for the insurance sector. By focusing on this niche, you get tools that help manage policies, claims, and billing efficiently. This specialization ensures that all features fit perfectly with the unique needs of insurance businesses.

b. The Problem:

- Before Guidewire, insurance companies relied on old, on-premise systems that were slow, expensive, and difficult to maintain. These legacy systems caused inefficiencies, errors, and poor customer service. It was hard to process data, adapt to new regulations, or offer digital experiences. You see that modernizing operations without the right tools was time-consuming and costly.

c. The Vertical SaaS Solution:

- Guidewire created a cloud-based platform that manages the entire insurance process. Its products, PolicyCenter, ClaimCenter, and BillingCenter, help you track policies, claims, and payments in one system. By connecting all operations, you can deliver faster claims processing, accurate billing, and better digital experiences to customers while improving efficiency and reducing operational errors.

d. Why It’s Dominant:

- Guidewire is dominant because it becomes deeply embedded in insurance operations. Replacing it is extremely costly and time-consuming. Its expertise in insurance workflows, reinsurance, and regulations makes it irreplaceable. Once installed, the platform acts as the foundation of daily business activities, creating strong loyalty and high switching costs, ensuring insurers stick with it long-term.

e. The Investor Appeal:

- Investors are drawn to Guidewire because it serves a large and stable industry that depends on its software daily. Its long-term contracts and predictable recurring revenue make it financially reliable. Since insurers rarely switch platforms, it ensures consistent income. Its success as a public company under ticker GWRE proves its market strength and lasting investment value.

3.7 Blend: Digitizing the Mortgage Lending Process

a. The Vertical:

- You learn that Blend focuses on the banking and mortgage lending industry. It helps financial institutions handle complex loan processes easily. By using Blend, you can simplify how borrowers and lenders interact. It improves digital experiences for both sides, making loan applications faster, smoother, and more transparent in an industry that depends on trust.

b.The Problem:

- You understand that the mortgage application process was full of paperwork, manual data entry, and endless communication. Borrowers faced confusion, and lenders wasted time verifying details. These delays made loan approvals slow and stressful. Blend saw this inefficiency and created a way for you to manage everything digitally, saving time and reducing frustration for everyone.

c. The Vertical SaaS Solution:

- You use Blend’s cloud-based platform to simplify the loan origination process. It gives borrowers a mobile-friendly experience and provides lenders with powerful data tools. This platform connects all the steps of a loan in one place, helping you process applications faster, minimize errors, and make the overall experience more efficient and user-friendly.

d. Why It’s Dominant:

- You see that Blend dominates because it focuses on a complex financial process and makes it fully digital. It connects with trusted data sources like the IRS and payroll systems to reduce fraud and speed up loan approvals. This helps you compete with modern fintech firms, giving both lenders and borrowers confidence and convenience.

e. The Investor Appeal:

- You notice that Blend attracts investors because it operates in a multi-trillion-dollar market. It doesn’t stop at mortgages but expands into other loan types, creating more opportunities for growth. With its strong market position and scalable platform, you understand why investors view it as a valuable and long-term business success story.

3.8 LeafLink: The Wholesale Platform for Cannabis

a. The Vertical:

- LeafLink serves the legal cannabis industry, including dispensaries and cannabis brands. It is a Vertical SaaS because it provides software specifically designed for this niche market. By focusing only on cannabis businesses, you get tools that fit the unique needs of ordering, payments, and compliance, making it much easier to run wholesale operations efficiently and safely.

b.The Problem:

- Before LeafLink, the cannabis supply chain was chaotic and inefficient. Businesses relied on phone calls, texts, spreadsheets, and paper invoices, which made tracking every transaction difficult. You faced constant challenges with compliance in a highly regulated market, and managing orders or payments was time-consuming and error-prone, slowing down operations and creating risk for your business.

c. The Vertical SaaS Solution:

- It provides a B2B wholesale marketplace and management platform for cannabis businesses. It helps you manage ordering, payments, logistics, compliance, and analytics in one place. By connecting brands and retailers, the platform streamlines the entire supply chain, making operations more efficient, reducing errors, and ensuring you follow all regulations without juggling multiple disconnected tools.

d. Why It’s Dominant:

- LeafLink became the default platform in the legal cannabis market because it solved both efficiency and compliance challenges. By creating a centralized and standardized system, you can manage wholesale transactions reliably and safely. Its platform allows every business in the network to operate smoothly, which strengthens its market position and makes it the first choice for cannabis retailers and brands.

e. The Investor Appeal:

- Investors are drawn to LeafLink because it operates in a high-growth emerging market. Its combination of Vertical SaaS, a two-sided marketplace, and payments capabilities gives it a competitive advantage. You can see its dominant position in the legal cannabis industry, which ensures strong growth potential, recurring revenue, and a clear path to profitability for investors.

3.9 Squire: The Barbershop Back Office

a. The Vertical:

- Squire serves the barbershop and high-end salon industry. It is a Vertical SaaS because it is designed specifically for these businesses, not general service companies. By focusing on barbershops, you get tools that fit appointments, payroll, and payments perfectly. This specialization helps you manage daily operations efficiently and makes the platform highly relevant to your business needs.

b.The Problem:

- Before Squire, barbershops struggled to manage appointments, payroll for chair-renting barbers, and point-of-sale systems. You had to use multiple generic tools that didn’t integrate, causing confusion, errors, and wasted time. This made running your shop stressful and inefficient. Barbershops needed a specialized platform to handle operations smoothly and reduce the administrative burden.

c. The Vertical SaaS Solution:

- It offers an all-in-one platform that manages appointment bookings, payments, and payroll specifically for barbershops. It also includes line management and branded apps for each shop. By using this platform, you can run your business more efficiently, save time, reduce mistakes, and provide a better experience for both staff and clients without juggling multiple tools.

d. Why It’s Dominant:

- Squire is dominant because it understands the unique financial model of barbershops, where many barbers are independent contractors. Its tailored solution addresses pain points that generic scheduling or POS software cannot handle. By solving these specific challenges, you get a platform that is essential to your business, creating strong customer loyalty and high switching costs for competitors.

e. The Investor Appeal:

- Investors are attracted to Squire because it serves an underserved niche in the beauty market. Its focus on financial operations like payments and payroll creates a clear path to high-margin revenue. By solving real problems for barbershops and salons, it becomes a scalable business with predictable growth, making it a strong investment in the Vertical SaaS market for SMBs.

3.10 LogicGate: Automating Risk and Compliance

a. The Vertical:

- LogicGate serves the corporate governance, risk, and compliance (GRC) industry. It is a Vertical SaaS because it focuses on providing software specifically for managing risk, compliance, and internal audits. By specializing in GRC, you get tools that are tailored to your company’s regulatory needs, making it easier to track processes, stay compliant, and reduce operational risks effectively.

b.The Problem:

- Before LogicGate, companies managed risk assessment, compliance, and audits using spreadsheets and emails. This caused inefficiency, mistakes, and operational risk. You would spend hours manually tracking processes and trying to ensure regulatory compliance. It was hard to keep workflows organized, and missing steps could result in penalties or business disruptions.

c. The Vertical SaaS Solution:

- LogicGate provides a cloud-based platform that lets you build, automate, and manage GRC workflows without coding. It helps you visualize risks, maintain compliance with regulations like GDPR or CCPA, and streamline audits. By centralizing all these processes, you can operate efficiently, reduce mistakes, and ensure your company meets regulatory standards consistently.

d. Why It’s Dominant:

- LogicGate is dominant because it treats GRC as its own vertical. It offers horizontal flexibility like other SaaS tools, but includes pre-built templates, content, and domain expertise specific to GRC. You can implement the platform quickly, adapt it to your workflows, and gain better results compared to generic risk management software.

e. The Investor Appeal:

- Investors like LogicGate because it solves a universal business problem with a vertical-specific approach. Its no-code platform allows rapid scaling across industries and use cases. By turning risk and compliance management into a scalable, repeatable platform, you see predictable growth potential and a strong path for recurring revenue, making it an attractive investment.

Understanding What Investors Value in Vertical SaaS

- As a founder, you need to know what venture capitalists look for when evaluating a Vertical SaaS startup. They focus on key factors that make your business scalable, profitable, and defensible. This includes identifying a large and underserved niche, having founders with deep domain expertise, building a platform rather than just a single tool, and demonstrating clear monetization and expansion potential. Meeting these criteria increases your chances of attracting investment and long-term growth in the competitive SaaS market. Let’s discuss this in detail:

4.1 A Large, Underserved Niche:

- Investors seek markets that are large enough to support rapid growth yet fragmented and underserved. Industries that rely on pen-and-paper or outdated software are prime candidates because there is room for digital disruption. By targeting such niches, you have a chance to capture a large portion of the market, solve real problems, and grow into a unicorn. Focusing on these niches ensures your product addresses genuine pain points, making adoption faster and giving your startup a competitive advantage over general solutions. Investors are attracted to these opportunities because they combine high growth potential with relatively low competition in the early stages.

4.2 Founders with Deep Domain Expertise:

- Investors highly value founders who have a deep understanding of their industry. If you have firsthand experience with the challenges your target customers face, you can create solutions that genuinely meet their needs. Collaborating with a technical co-founder ensures your product is not only practical but also well-built. Your credibility as an insider helps secure early customers and pilot programs, which are crucial for proof of concept. Investors know that founders with deep domain knowledge are more likely to anticipate market trends, build trust with clients, and scale effectively, making the startup less risky and more likely to succeed in the long term.

4.3 A Platform, Not Just a Point Solution:

- Investors prefer startups that can become the central operating system for an industry rather than offering a single tool. Your initial product must have a clear vision and flexible architecture so it can expand into a full-suite platform over time. By planning for growth from the start, you can add new features, integrate additional modules, and increase customer dependency. This makes your solution more valuable to clients because it becomes essential to daily operations. Investors see this as a strategic advantage because a platform with multiple touchpoints creates high switching costs and long-term customer loyalty.

4.4 Clear Monetization and Expansion Potential:

- Investors look for a business model that goes beyond simple subscriptions. You should demonstrate a path to multiple revenue streams like marketplace fees, payment processing, and embedded financial services. These additional channels increase revenue per customer and reduce reliance on one source of income. By showing how your Vertical SaaS can expand its offerings within the industry, you prove its scalability and long-term growth potential. Investors are drawn to this approach because it ensures predictable recurring revenue and higher profitability, making your startup a more attractive and sustainable investment.

The Future is Vertical

- The future of software is moving toward Vertical SaaS because understanding your customers’ unique industry needs is more important than just technology. By focusing on specific markets, leveraging AI, and deeply embedding into operations, you can become an essential partner, driving growth, loyalty, and long-term success in your niche.

5.1 Shift from Technology to Domain Expertise:

- The software industry is no longer just about cloud technology. You need to focus on deep domain expertise to truly understand your customers’ workflows and challenges. When you know the industry inside out, you can build software that fits perfectly and solves real problems. This gives your Vertical SaaS company a strong competitive advantage, making it harder for generic tools to replace your solution and increasing your chance to dominate your niche.

5.2 Focus on Undigitized Industries:

- Many industries are still early in digital adoption, meaning they rely on old processes and manual systems. You can target sectors like agriculture, construction, and education with Vertical SaaS tools that streamline operations. By creating software tailored to these industries, you help them become more efficient, save time, and improve outcomes. Focusing on underserved industries allows you to capture market share quickly and establish your product as the standard before competitors enter.

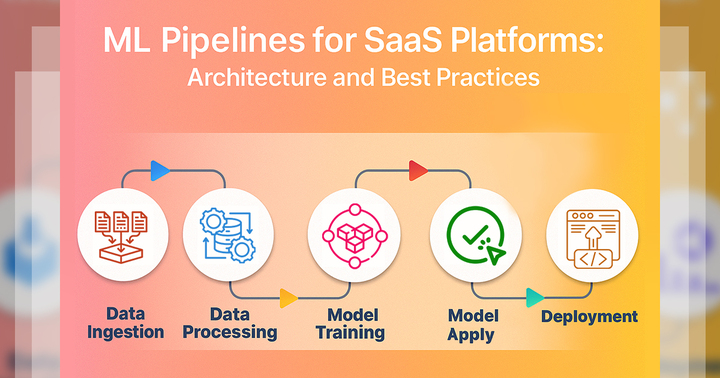

5.3 AI and Machine Learning Integration:

- Vertical SaaS companies can use industry-specific data to apply AI and machine learning, giving you powerful insights. You can predict trends, automate complex workflows, and help customers make smarter decisions. For example, in agriculture, AI could predict crop yields, while in construction, it could flag project risks. By leveraging these technologies, your software becomes more than a tool; it becomes an intelligent partner that adds huge value to daily operations and strengthens customer loyalty.

5.4 Becoming Indispensable Partners:

- The most successful Vertical SaaS companies embed themselves deeply into daily business operations. When your platform handles core processes like scheduling, payments, or compliance, it becomes essential. Customers depend on it to run their business smoothly, which creates high switching costs and strong loyalty. By becoming a central part of how businesses operate, you ensure your platform is not just nice to have but critical, making it difficult for competitors to take your place.

5.5 Continued Innovation and Investment:

- Investors are drawn to Vertical SaaS companies with strong domain expertise and a clear plan for growth. As long as you keep innovating, expanding into new niches, and solving real problems, investors will continue funding your startup. By targeting industries that are still digitizing and using advanced tools like AI, you demonstrate high potential for market leadership. This ensures long-term growth, repeated investment, and the ability to become the go-to solution for your niche customers.

Conclusion

- Vertical SaaS is not just another software trend—it is a strategic revolution for founders and investors. By focusing on specific industries, you escape the crowded, costly world of horizontal software and build a business rooted in deep domain expertise, unmatched product value, and solid fundamentals. You aren’t just creating software; you are digitizing entire industries, transforming how they operate, communicate, and grow. For investors, this means predictable revenue, strong customer loyalty, and a defensible competitive advantage.

- It allows you to scale rapidly, expand strategically, and embed your solution so deeply that it becomes indispensable. You are no longer competing in generic markets; you are defining the future of niche industries. With the right vision and execution, Vertical SaaS positions you at the forefront of innovation, growth, and long-term profitability.